Profitable energy renovation – new calculation tool In BIM Energy Renovation

In BIM Energy Evaluation, there are two methods for assessing the economic consequences of renovation, measures proposed by the user to reduce energy use in a building. With these methods, payback time or energy savings cost (or both) are calculated.

The payback time speaks in all its simplicity about how long it takes until an energy renovation cost is paid for by future annual energy cost savings, while the savings cost is defined as the renovation cost divided by the energy savings during the lifetime of the measure. The result is a savings cost per kWh for the measure.

The great merit of the payback time method is its simplicity, both in terms of the calculation procedure and the intuitive interpretation of the result:

“How many years will it take for the investment to pay for itself”?

Despite the simplicity (or perhaps precisely because of it), it is a method that is used extensively and can be considered sufficient for many simple investment decisions, but the disadvantages of the method include, among other things, that it does not take into account financial demands for the return on the investment (discount rate) in comparison with alternative uses of the company’s capital and that the method is not suitable for comparing investments with different limited lifetimes. The method is, therefore, generally considered unsuitable for serious investment calculations.

The savings cost method is also a simplified way of calculating profitability where the calculated savings cost in some monetary unit per accumulated energy unit saved during the lifetime of the measure, for example, SEK/kWh, can be easily compared with the market price for the type of energy that is relevant for the comparison and thus constitute an indication of whether the investment tends to be profitable or not. The method is prescribed when it comes to reporting proposed energy management measures in connection with energy declarations in Sweden.

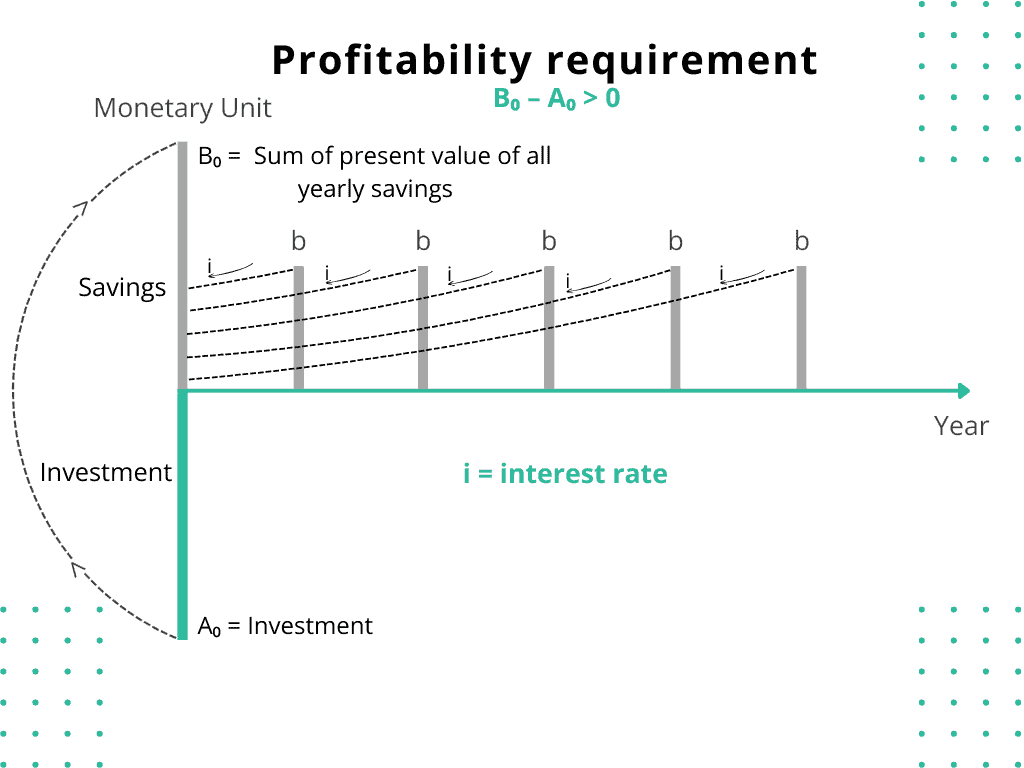

In BIM Energy Renovation, however, a more advanced and established method for calculating profitability has been added: the net present value method (NPV), which is based on following the payment streams for any number of years in the future (often 40–60), starting with the basic investment, which is a cost and then with a number of years of energy cost savings, i.e. future earnings.

Annual or periodic maintenance costs can also be included in the calculation. An essential parameter for the calculation of the net present value, which affects profitability, is the choice of the level of internal discount rate. This can be said to correspond to the property owner’s demand for a return on invested capital. In the real estate industry, levels of about 4% are usually expected for public housing companies and upwards of 8% for commercial real estate companies.

The criterion for the profitability of the energy renovation is that the net present value is positive, i.e. that the accumulated savings in energy costs during the life of the building exceeds the cost of the energy renovation and other relevant costs during the same period.

With the net present value method, the profitability of individual energy management measures can be studied, but also combinations of several measures, so-called measure packages. In this way, you can easily obtain profitability measures for the entire renovation package, which forms a good basis for investment decisions. In BIM Energy Renovation, a menu of common energy renovation measures is provided that the users can choose from, but of course, it is also possible to put together their own measures and measure packages for the program to analyse.

All profitability calculations in all industries naturally require estimates of costs, in this case, investment costs for the energy measures, but also any necessary annual or periodic maintenance. Renovation costs depend on the technology that is intended to be used for the renovation, the general price level in the industry, the state of the economy, the local market, and more. Definitive decisions on renovation measures must, therefore, be based on reliable input data, usually in the form of tenders from the intended contractor or supplier.

The net present value method, NPV is an economic analysis method to assess the profitability of a measure/investment by comparing all the costs of the measure with future savings during the life of the building, while a life cycle cost analysis (LCC) is a method that focuses on assessing all the costs that are linked to a product or service over its life cycle.

Both methods use an internal discount rate to recalculate future savings or costs in today’s value. LCC analysis is well suited for new investments in products or technology, but the method is used less often for renovation, where savings because of various renovation measures are of central interest. The LCC method is, therefore, not implemented in BIM Energy Renovation.

Source: Nilsson, P.E (ed.), Achieving the Desired Indoor Climate – Energy Efficiency Aspects of System Design, Sudentlitteratur, Lund Sweden, 2003